Lodging Your First SMSF Annual Return: What You Need to Know (Australia)

Setting up a Self-Managed Super Fund (SMSF) is a big step towards taking control of your retirement savings. But once your fund is established, one of your most important responsibilities as a trustee is lodging your SMSF Annual Return (SAR).

If this is your first year, here’s what you need to know to stay compliant and avoid unnecessary stress.

Written By:

Emelia Afful (CA)

Director

This guide outlines what the return includes, when it is due and the essential steps you must complete before lodging, including preparing financial statements, arranging an independent audit and paying the supervisory levy. Understanding these obligations early helps you avoid penalties, maintain your fund’s regulatory status and set a strong compliance foundation from the start.

What Is the SMSF Annual Return (SAR)?

The SMSF Annual Return is lodged with the Australian Taxation Office (ATO) each financial year.

It is not just a tax return.

Your SAR includes:

- The SMSF income tax return

- Regulatory information required by the ATO

- Member contribution reporting

- Payment of the SMSF supervisory levy

Even if your SMSF has no tax payable, you must still lodge a return (unless specific exceptions apply — explained below).

The ATO considers this one of the most essential obligations of an SMSF trustee.

When Is Your First SMSF Return Due?

If you are lodging the return yourself, the standard due date is 31 October

However, if you engage a registered tax agent before the deadline, you may be eligible for an extended due date (generally 28 February of the following year), provided your fund is included in their lodgment program.

Important: Always check your ATO registration letter. Some newly registered SMSFs must still lodge by 31 October, even if using a tax agent.

Step-by-Step: What You Must Do Before Lodging

Each year, there is a specific process to follow:

Prepare the Fund’s Financial Accounts

You must:

- Prepare financial statements

- Value all SMSF assets at market value

- Ensure all transactions are correctly recorded

This includes property, shares, managed funds, crypto, term deposits — everything.

Appoint an Approved SMSF Auditor

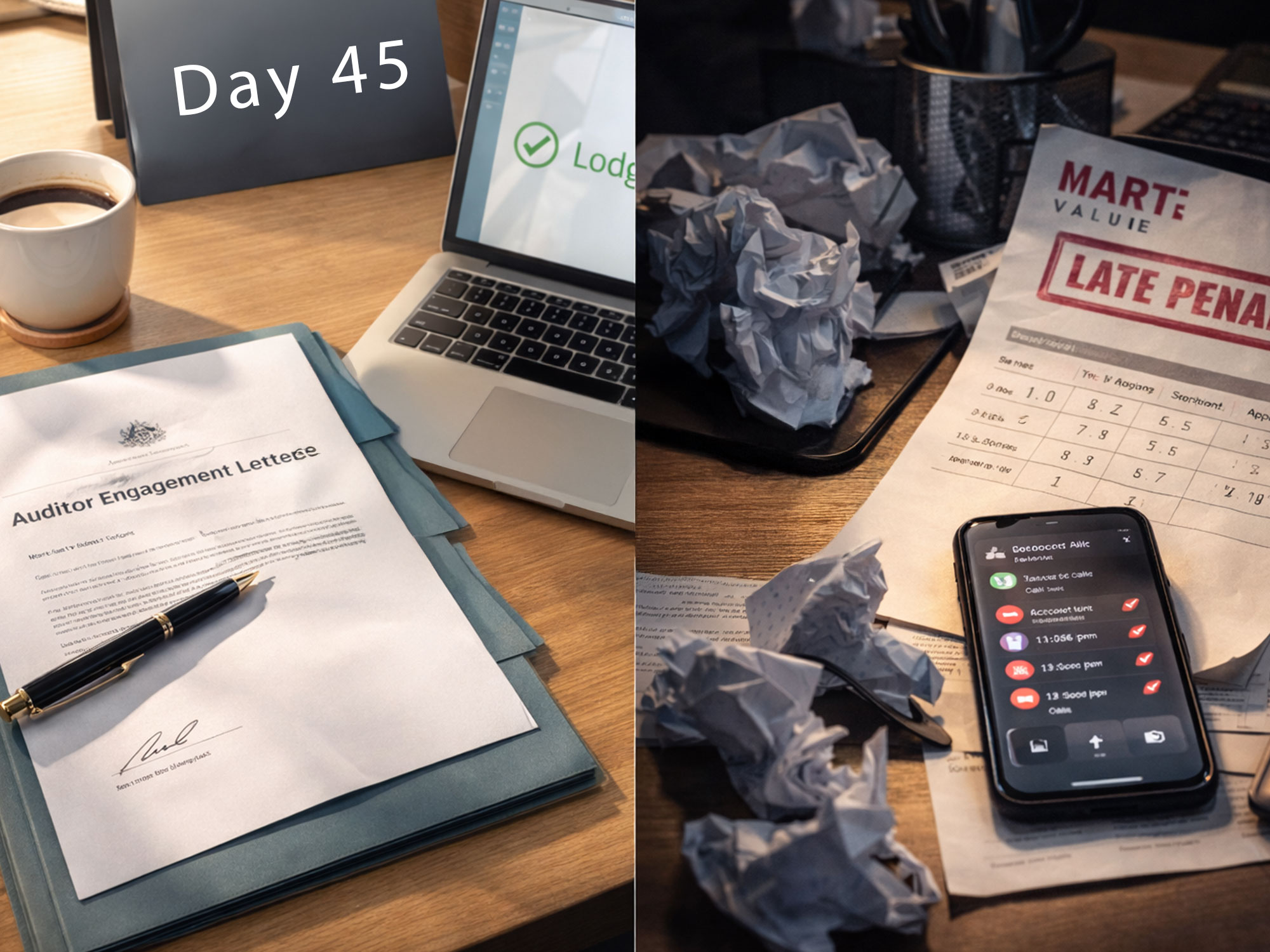

You must appoint an approved SMSF auditor at least 45 days before the return is due.

The auditor must:

- Review your financial statements

- Assess compliance with super laws

- Provide an independent audit report

Without the audit report, you cannot lodge your SAR.

Lodge the SAR and Pay Obligations

Once everything is finalised, you must:

- Lodge the SMSF Annual Return

- Pay any tax payable

- Pay the supervisory levy

How Much Is the Supervisory Levy?

For new SMSFs, the levy is $518.

This covers:

- The year your SMSF was established

- The following financial year

After that, the levy reduces to the standard annual amount.

What Happens If You Lodge Late?

Failing to lodge your SAR on time can have serious consequences.

The ATO may change your fund’s status on Super Fund Lookup to:

“Regulation details removed”

This can result in:

- Rollovers being blocked

- Employer contributions being rejected

- Loss of tax concessions

- Administrative penalties

In addition, paper lodgments can take up to 50 days to process. If lodging by paper, allow extra time.

What If Your SMSF Has No Assets Yet?

This is an area many new trustees misunderstand.

An SMSF is not legally established until it holds assets for members.

If your SMSF:

- Had no assets

- Received no contributions

- Received no rollovers

- Did not operate in its first year

Then you do not need to lodge a return for that year.

Instead, you must either:

Option 1: Cancel the SMSF registration

If you decide not to proceed with the fund.

OR

Option 2: Lodge a “Return Not Necessary” (RNN) request

You must confirm in writing that:

- The SMSF had no assets

- No contributions or rollovers were received

- You have evidence of when the fund first held assets

- You will lodge future returns once operational

This can be done by you or your tax agent.

Common First-Year Mistakes

New SMSF trustees often:

- Forget to appoint an auditor early

- Miss the 45-day rule

- Don’t value assets properly

- Assume no tax = no lodgment required

- Wait until the last minute to contact their accountant

SMSFs are heavily regulated. Administrative oversights can quickly escalate into compliance problems.

Where to Get Help

The ATO provides interactive learning modules and guidance for trustees. However, SMSF compliance is technical and strict.

Working with an experienced tax agent ensures:

- Correct reporting

- On-time lodgment

- Proper audit coordination

- Avoidance of penalties

- Peace of mind

Final Thoughts

Setting up an SMSF gives you control — but with that control comes responsibility.

Your first SMSF Annual Return sets the tone for your fund’s compliance record. Getting it right from the beginning helps protect:

- Your retirement savings

- Your tax concessions

- Your fund’s regulatory status

If you are unsure about your obligations or approaching your first SMSF deadline, speak with your registered tax adviser early.

Because when it comes to superannuation — compliance is not optional.

Recent Blog Posts

Read our latest insights on managing your money, building wealth, and achieving your financial goals.

Lodging Your First SMSF Annual Return: What You Need to Know (Australia)

Lodging your first SMSF Annual Return is a critical responsibility for Australian trustees. Learn about deadlines, mandatory audits, and supervisory levies to ensure your fund…

Christmas Parties, Gifts and Bonuses: Your Complete FBT Guide for 2025

A clear guide to FBT on Christmas parties, gifts and bonuses in 2025, helping businesses stay compliant and plan tax-effective festive rewards.

ATO Targets $1B from Dodgy Landlords!

Attention landlords: The ATO is cracking down on unreported rental income and incorrect deductions, targeting a $1.2B tax gap. Ensure your tax return is compliant.