Understanding Early Access to Superannuation: A Critical Guide

Written By:

Emelia Afful (CA)

Director

Superannuation is an essential part of Australia’s retirement system, designed to support individuals financially once they reach retirement age. While it’s generally off-limits until retirement, there are certain circumstances where early access to your super may be allowed. However, accessing your super early without meeting these specific conditions can have severe consequences.

When is Early Access to Super Permitted?

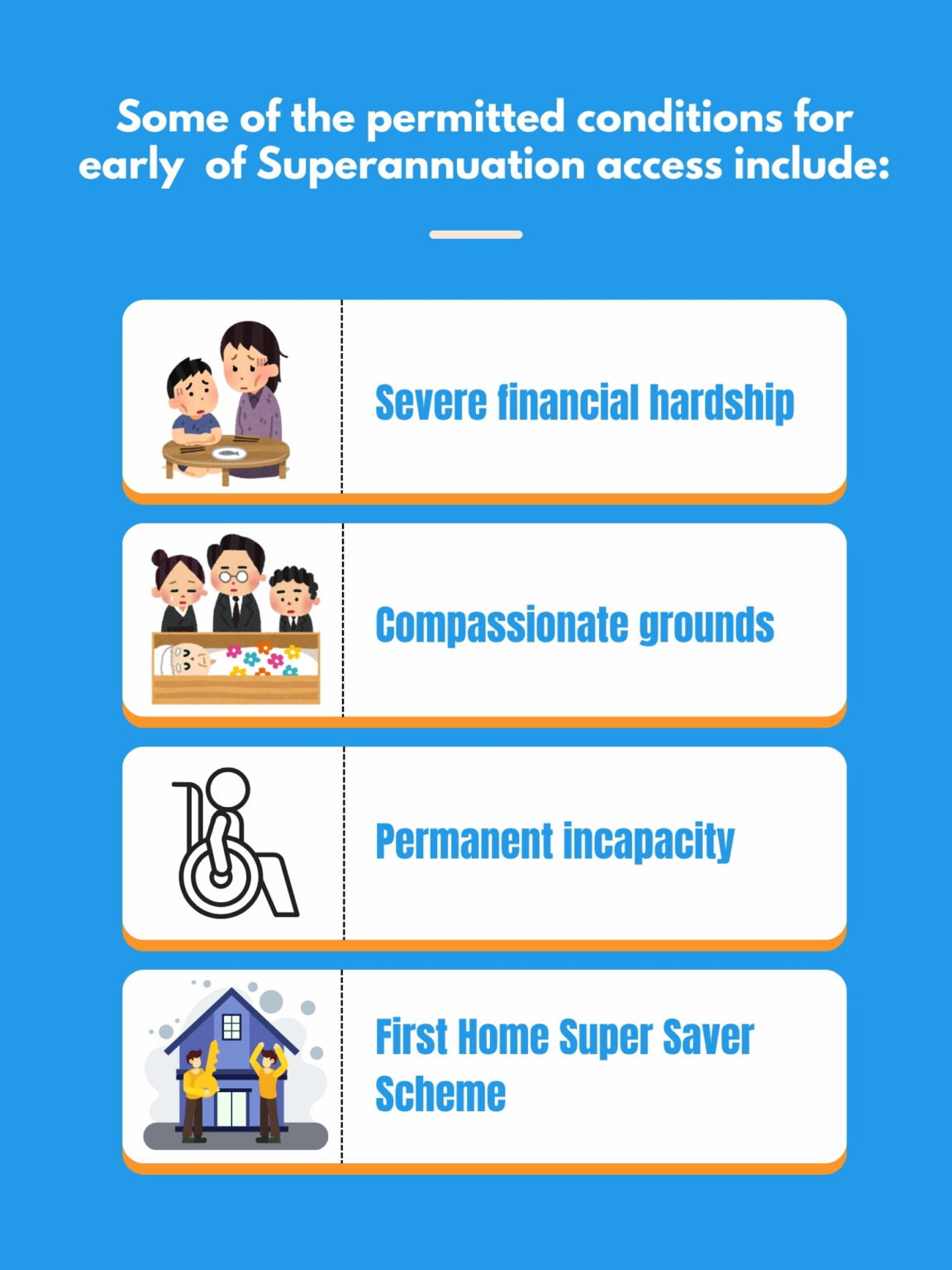

The Australian Taxation Office (ATO) has strict rules around when you can access your superannuation before retirement. Some of the permitted conditions for early access include:

- Severe financial hardship: If you are unable to meet reasonable living expenses and have been on government benefits for a certain period, you may be able to access a portion of your super.

- Compassionate grounds: These are limited to situations such as needing to pay for medical treatment or funeral expenses, or if you are facing eviction from your home.

- Permanent incapacity: If you become permanently unable to work due to physical or mental incapacity, early access to your super may be granted.

- First Home Super Saver Scheme: If you’re a first-time home buyer, you can access your super savings to help with the purchase of a home.

Beyond these cases, accessing your super early is considered illegal and can result in serious penalties.

The Risks of Illegal Early Access

In the 2021–22 period, illegal early access from SMSFs (Self-Managed Superannuation Funds) alone was estimated at a staggering $250.1 million. Engaging in illegal early access can be detrimental in multiple ways:

- Loss of retirement savings: Once you take money out of your super before retirement age, you lose the potential growth it could have earned, leaving you with less for your retirement.

- Tax and penalties: The ATO will impose additional taxes, penalties, and interest on any funds accessed illegally, compounding the financial strain.

- Trustee disqualification: SMSF trustees who facilitate or approve illegal early access can face administrative penalties and be disqualified from acting as a trustee.

These actions can also place significant strain on the broader superannuation system and raise concerns regarding the integrity of SMSFs.

The Consequences of Non-Compliance

Trustees of SMSFs are legally obligated to ensure that the funds in the superannuation fund are used for legitimate purposes. If funds are accessed without meeting the necessary conditions of release, it can lead to serious consequences:

- SuperFund Lookup Removal: If an SMSF is found to be non-compliant, it can be removed from SuperFund Lookup. This means the SMSF can no longer receive contributions, leading to liquidity issues for the fund and negatively impacting the members’ retirement savings.

- Late or Non-Lodgement of SMSF Annual Returns (SARs): A failure to lodge SMSF annual returns can indicate that illegal early access may be happening, and it will raise red flags for the ATO. Trustees may be investigated for potential non-compliance.

- Collaborations with ASIC: The ATO works closely with the Australian Securities and Investments Commission (ASIC) to identify non-compliant funds. When a fund is flagged as non-compliant, corrective actions are taken, which could include financial penalties or removal from regulatory listings.

What to Do if You’ve Been Involved in Illegal Early Access

If you’ve accessed your super early without meeting the legal conditions, or have been involved in a scheme promoting illegal early access, it is important to take immediate action. The ATO offers a voluntary disclosure service, where you can report your circumstances and, in some cases, reduce penalties.

Engaging in voluntary disclosure can result in more lenient penalties, as the ATO takes into account your willingness to come forward and correct any violations.

Prohibited Loans: A Serious Concern

Another area of concern for SMSF trustees is prohibited loans. Under the law, loans to SMSF members or related parties are prohibited. In the 2021–22 financial year, it was estimated that $231.7 million was inappropriately withdrawn from SMSFs through prohibited loans.

Trustees should be particularly vigilant in ensuring that no loans are made from the SMSF to members or related parties. Violating this regulation can lead to significant financial penalties, regardless of whether the loan is repaid.

Stay Informed and Compliant

If you’re an SMSF trustee, it’s essential to stay informed about your obligations and the risks of non-compliance. The ATO regularly updates its guidance on SMSF regulations, and you can subscribe to the SMSF newsletter to receive the latest news and tips. Additionally, it’s advisable to review your SMSF’s practices regularly to ensure that no illegal activity is taking place.

Conclusion

Early access to superannuation should only be considered in rare and specific circumstances. If you’re tempted by schemes promising early access to your super, be aware of the severe consequences of doing so illegally. These actions can jeopardise your retirement savings and result in heavy penalties. Always ensure that your superannuation is handled according to the law and seek professional advice if you have any doubts about accessing your super early.

If you have any questions about managing your SMSF or need help ensuring compliance, feel free to contact us for expert advice and assistance.

Recent Blog Posts

Read our latest insights on managing your money, building wealth, and achieving your financial goals.

Christmas Parties, Gifts and Bonuses: Your Complete FBT Guide for 2025

A clear guide to FBT on Christmas parties, gifts and bonuses in 2025, helping businesses stay compliant and plan tax-effective festive rewards.

ATO Targets $1B from Dodgy Landlords!

Attention landlords: The ATO is cracking down on unreported rental income and incorrect deductions, targeting a $1.2B tax gap. Ensure your tax return is compliant.

Division 7A Myths: What Every Private Company Owner Needs to Know

Debunk common Division 7A myths! Learn why your company's money isn't your own, the rules for loans, and how to avoid costly ATO deemed dividends.